Use this reference to understand which 1099 forms print from Aatrix, the required paper types, and how many forms are printed per page. This includes details for Federal, State, Payer, and Recipient copies, as well as which forms require official red ink paper.

Printing Details

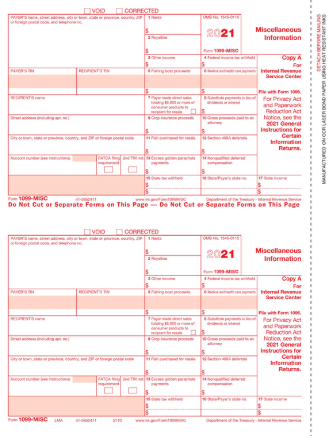

1. Federal 1099 & 1096 Forms

Paper Type: Official IRS red-ink forms (data only).

Notes: These forms must be printed on the red, pre-approved paper.

Verify print alignment to ensure data fits correctly within the designated boxes.

2. State 1099 Forms

Paper Type: Blank four-part perforated paper.

Print Format: Four different recipients per page.

Notes: State copies are formatted for four recipients per sheet.

It is recommended to use standard four-part perforated paper.

State reconciliation reports are approved for direct printing and mailing.

3. Payer 1099 Copies

Paper Type: Plain paper or four-part perforated paper.

Print Format: Four different recipients per page.

Notes: These copies are for payer recordkeeping only and do not require special forms.

4. Recipient 1099 Copies

Paper Type: Blank four-part perforated paper with “Instructions to Recipient” printed on the back.

Print Format: Four identical copies of the same recipient per page.

Notes: This paper can also be purchased through your accounting software provider.

Ensure proper alignment before printing to maintain compliance with IRS formatting standards.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article