You should initialize the tax update before processing the first payroll of 2026. Once initialized, do not reprocess any prior 2025 payroll periods.

Download and update taxes after printing and posting the final payroll of the previous year and closing the year, but before processing checks for the first payroll of the New Year.

While initializing the tax routine updates ensures tax rates are current for the New Year, you may still need to adjust local taxes and company-specific rates, such as state unemployment rates.

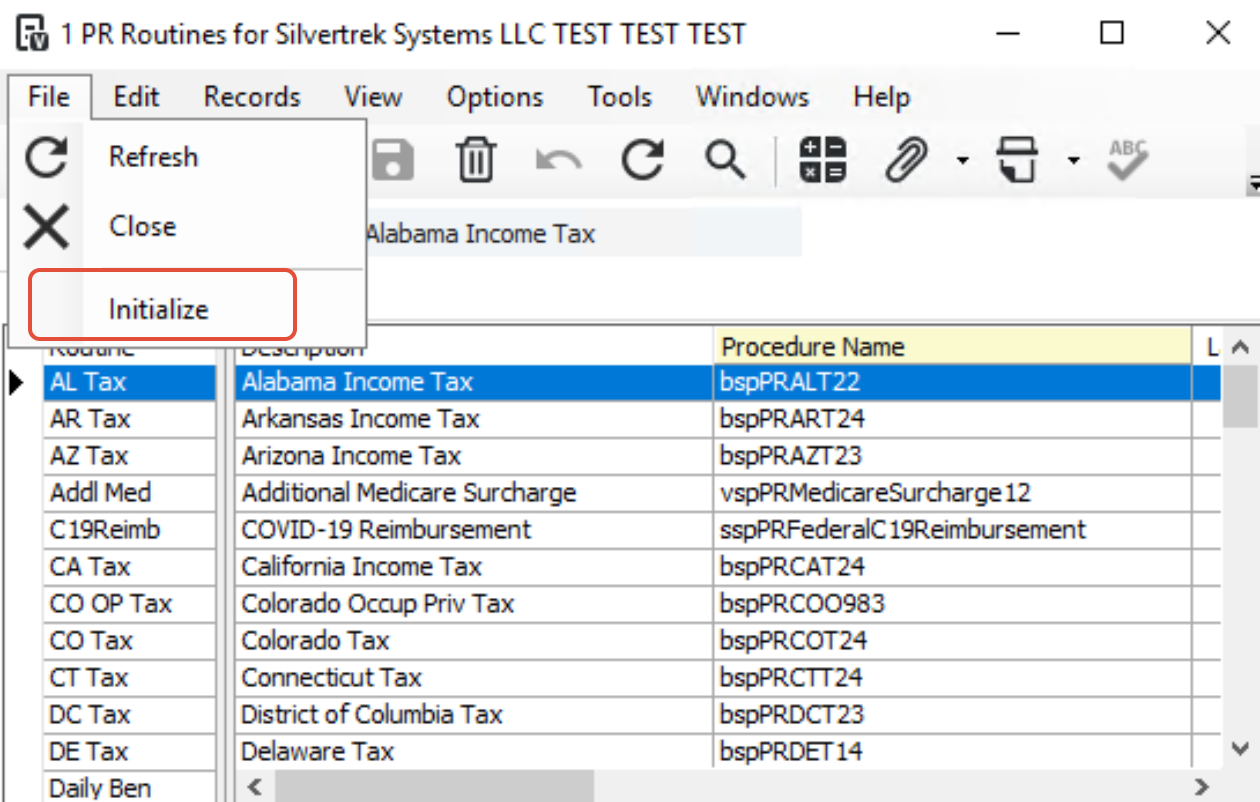

To initialize the tax update: open PR Routines, select File, then Initialize. This process must be completed for each PR company you manage.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article